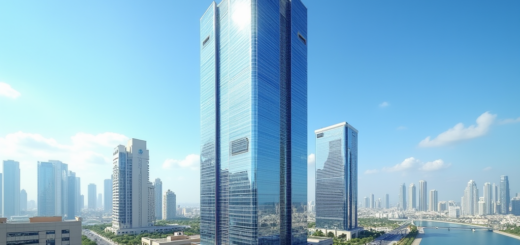

Business Setup in Dubai: A Comprehensive Guide

Setting up a business in Dubai offers endless opportunities due to its strategic location, tax benefits, and thriving economy. Entrepreneurs looking to establish their ventures can benefit from a robust infrastructure, free trade zones, and a supportive business environment. This article delves into the key considerations for business setup in Dubai, including legal requirements, types of licenses, and the advantages this global city provides.

Understanding the Business Landscape in Dubai

Dubai is renowned for its cosmopolitan culture and progressive economic policies, making it a perfect destination for business expansion. The city boasts a diverse economy, with sectors like tourism, finance, real estate, and technology driving growth. Entrepreneurs must first understand the landscape to make informed decisions. Key factors to consider include:

- Market Demand: Identifying industries with high demand and consumer needs is crucial.

- Competition: Analyze your competitors to find gaps in the market.

- Regulatory Environment: Familiarize yourself with laws governing business operations.

- Location: Choose between mainland, free zones, or offshore setups based on business goals.

- Economic Stability: Take advantage of Dubai’s stable economic situation, supported by the government.

Types of Business Licenses in Dubai

Before embarking on your entrepreneurial journey, it’s essential to choose the right type of business license. Dubai offers various licenses based on business activities, which include:

- Commercial License: Required for trading activities.

- Professional License: For service providers and professionals.

- Industrial License: For manufacturing and industrial activities.

- Tourism License: Necessary for tourism-related businesses.

Each license category comes with its requirements and processes. Understanding these will help streamline your application and prevent potential legal issues. Engaging local authorities or business consultants can enhance your comprehension of regulatory nuances and ensure compliance.

Steps to Register Your Business

Establishing a business in Dubai requires careful adherence to various steps, which, when followed systematically, can make the process seamless. Here’s a simplified list of the key steps involved:

- Choose a Business Structure: Decide on whether it will be a sole proprietorship, partnership, or a company.

- Select a Business Name: Choose a unique and relevant name that complies with UAE naming conventions.

- Apply for Initial Approval: Apply for a trade license and obtain approval from the Department of Economic Development (DED).

- Draft a Memorandum of Association (MOA): Outline the ownership structure and internal regulations.

- Secure Location: Obtain a tenancy contract for your business premises.

- Submit Documents: Compile and submit all required documents for final approval.

Completing these steps successfully will result in your business being officially registered, allowing you to operate in the dynamic Dubai market.

Establishing a business in Dubai presents several unique advantages that are alluring to local and foreign entrepreneurs alike. Some of these benefits include:

- Tax-Free Environment: Dubai offers zero personal income tax and corporate tax incentives in free zones.

- Strategic Location: It serves as a global trading hub, providing easy access to markets in the Middle East, Africa, and Asia.

- Robust Infrastructure: World-class facilities, transport networks, and logistics to support business operations.

- Access to Talent: A multicultural workforce enables businesses to hire skilled professionals from across the world.

- Strong Government Support: Initiatives aimed at enhancing the entrepreneurial ecosystem encourage startup growth.

Conclusion

In conclusion, setting up a business in Dubai is a viable opportunity for those looking to tap into a flourishing market. With appropriate planning and a clear understanding of legalities, you can successfully establish a business in this vibrant city. The advantages, including tax benefits and economic stability, combined with a strategic location, make Dubai an ideal destination for both startups and established businesses. By following the outlined steps and considering the types of licenses available, entrepreneurs are well-positioned to thrive in the region’s dynamic economic environment.

Frequently Asked Questions

1. What is the cost of setting up a business in Dubai?

The cost varies significantly based on the type of business, location, and licensing. Generally, initial investments can range from AED 10,000 to AED 50,000 or more.

2. Can foreign investors own 100% of their business in Dubai?

Yes, foreign investors can own 100% of their business in designated free zones. However, in mainland areas, a local partner is required for certain activities.

3. How long does it take to set up a business in Dubai?

The timeline can differ but typically ranges from a few days to several weeks based on documentation and approvals required.

4. Is it necessary to have a physical office in Dubai?

Yes, businesses in the mainland require a physical office space, while free zone entities may have different conditions regarding physical premises.

5. What is the role of a local sponsor in Dubai business setup?

A local sponsor is often required for mainland businesses to comply with regulations. They hold 51% shares but typically do not interfere in company operations.